MAIN PUBLICATION :

| Home � ECONOMICS � Project Financing � Traditional methods |

|

Traditional Methods

WHAT IS PROJECT FINANCE?

Project finance is the term used to describe a structure in which the only security for a loan is the project itself. In other words, the owner of the project company is not personally, or corporately, liable for the loan. In a project finance deal, no guarantee is given that the loan will be repaid; however, if the loan is not repaid, the investor can seize the project and run or sell it in order to extract cash.

This process as rather like a giant property mortgage, since if a home owner does not repay the mortgage on time, the house may be repossessed and sold by the lender. Therefore, the financing of a project requires careful consideration of all the different aspects, as well as the associated legal and commercial arrangements. Before investment, any project finance lender will want to know if there is any risk that repayment will not be made over the loan term.

DEAL STRUCTURE

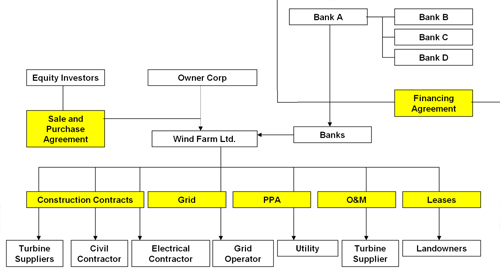

A typical, simple project finance deal will be arranged through a special purpose vehicle (SPV) company. The SPV is called 'Wind Farm Ltd' in Figure 3.1. This would be a separate legal entity which may be owned by one company, consisting of several separate entities or a joint venture.

One bank may act alone if the project is very small, but will usually arrange a lending syndicate – this means that a group of banks will join together to provide the finance, usually with one bank as the ‘lead arranger’ of the deal. This is shown in Figure 3.1, where Bank A syndicates the loan to Banks B, C and D.

Figure 3.1: Typical Wind Farm Finance Structure

Source: Garrad Hassan

A considerable amount of work is carried out before the loan is agreed, to check that the project is well planned and that it can actually make the necessary repayments by the required date. This process is called 'due diligence' and there is usually separate commercial, technical and legal due diligence carried out on behalf of the bank. The investors will make careful consideration of technical, financial and political risks, as well as considering how investment in a project fits in with the bank’s own investment strategy.

TYPICAL DEAL PARAMETERS

Generally, a bank will not lend 100 per cent of the project value and will expect to see a cash contribution from the borrower – this is usually referred to as ‘equity’. It is typical to see 25 to 30 per cent equity, and 70 to 75 per cent loan (money provided by the bank as their investment). Occasionally, a loan of 80 per cent is possible.

The size of the loan depends on the expected project revenue, although it is typical for investors to take a cautious approach and to assume that the long-term income will be lower than assumed for normal operation. This ensures that the loan does not immediately run into problems in a year with poor wind conditions or other technical problems, and also takes into account the uncertainty associated with income prediction.

Typically, a bank will base the financial model on the ‘exceedance cases’ provided within the energy assessment for the project. The mean estimated production of the project (P50) may be used to decide on the size of the loan, or in some cases a value lower than the mean (for example P75 or P90). This depends on the level of additional cash cushioning that is available to cover costs and production variation over and above the money that is needed to make the debt payments. This is called the debt service cover ratio (DSCR) and is the ratio of cash available at the payment date to the debt service costs at that date. For example, if €1.4 million is available to make a debt payment (repayment and interest) of €1 million, the DSCR is 1.4:1.

The energy assumptions used for the financial model and associated DSCR are always a matter of negotiation with the bank as part of the loan agreement. Some banks will take a very cautious approach to the assumed energy production, with a low DCSR and some will assume a more uncertain energy case, but with a high DSCR and sufficient cash cushioning to cover potential production variation.

The loan is often divided into two parts: a construction loan and a term loan. The construction loan provides funds for the construction of the project and becomes a term loan after completion. At the ‘conversion’ from a construction into a term loan, the terms and conditions associated with the loan change, as does the pricing of the debt. The term loan is usually less expensive than the construction loan as the risks are lower during operation.

Typically, the length of a loan is between 10 and 15 years, but loan terms have become longer as banks have become more experienced in the wind industry.

The interest rate is often 1-1.5 per cent above the base rate at which the bank borrows their own funds (referred to as the interbank offer rate). In addition, banks usually charge a loan set-up fee of around 1 per cent of the loan cost, and they can make extra money by offering administrative and account services associated with the loan. Products to fix interest rates or foreign exchange rates are often sold to the project owner.

It is also typical for investors to have a series of requirements over the loan period; these are referred to as ‘financial covenants’. These requirements are often the result of the due diligence and are listed within the ‘financing agreement’. Typical covenants include the regular provision of information about operational and financial reporting, insurance coverage and management of project bank accounts.

EXPERIENCE

In the last two decades, no wind industry project has ever had to be repossessed, although industry and project events have triggered some restructuring to adjust financing in difficult circumstances. The project finance mechanism has therefore served the industry and the banking community well. A decade ago, developers might have struggled to find a bank ready to loan to a project, whereas today banks often pursue developers to solicit their loan requirements. Clearly, this has improved the deals available to wind farm owners.

THE US

The description above covers most of the project financed loans arranged outside the US. Inside the US there are some very particular structures that are rather more complicated, as the US market is driven by tax considerations.

The renewable energy incentive in the US is the Production Tax Credit (PTC) and hence tax is of primary rather than secondary importance. Since this report focuses on the European market, it is not appropriate to describe the US approach in any detail, but basically it includes another layer of ownership - the tax investors - who own the vast majority of the project, but only for a limited period of time (say 10 years), during which they can extract the tax advantage. After that period there is an ownership 'flip' and the project usually returns to its original owner. Many sophisticated tax structures have been developed for this purpose and this characteristic has had a major effect on the way in which the US industry has developed. The owners of US wind farms tend to be large companies with a heavy tax burden. Another group of passive tax investors has also been created that does not exist in the wind industry outside the US.

| Acknowledgements | Sitemap | Partners | Disclaimer | Contact | ||

|

coordinated by  |

supported by  |

The sole responsibility for the content of this webpage lies with the authors. It does not necessarily reflect the opinion of the European Communities. The European Commission is not responsible for any use that maybe made of the information contained therein. |